Industries & Services

Insurance

Banking

Finance / Accounts

Mutual Funds

Infra / Constructions / Developers

Interior / Architect Designing

Realty/ISO Certifications

Lending Services

Legal Advisiory

Tax - Consulting

Engineering Works / Mining

Telecom

Textiles / Garments

Fertilizers / Service Sectors

Corporate Business Advisory

NGO / Trust / Society

Welfare Groups

Chit Fund Services

Logistics / Shipping / Transport

Recovery Management

ORBITZ PAY

AEPS SERVICE

AADHAAR PAYMENT

BBPS SERVICE

MONEY TRANSFER

Synopsis - Digital Payments

Digital payment is a way of payment which is made through digital modes. In digital payments, payer and payee both use digital modes to send and receive money. It is also called electronic payment. No hard cash is involved in digital payments. All the transactions in digital payments are completed online. It is an instant and convenient way to make payments.

Hassles in Non-Digital Payments

If we talk about cash payments, you have to first withdraw cash from your account. Then youuse this cash to pay at shops. Shopkeeper goes to the bank to deposit the cash which he got from you.This process is time-consuming for you and also for the shopkeeper. But in digital payments, themoney transfers from your account to the shopkeeper's account immediately. This process isautomatic and neither you nor the shopkeeper is required to visit the bank.

Digital payments save you from long queues of ATMs and banks. Because, if you pay digitally, you won't need to withdraw cash from your account.Now a day's Banks charging the for the ATMwithdraws. Also has the high risk of theft.

Advantages of Digital Payments

A convenient way to pay: Digital payments are more convenient than cash payments. You do not need to carry a lot of cash with you all the time. You can make digital payments in seconds. The change is not a concern with digital payments when you can pay the exact amount. You will also have all your payments recorded automatically. We all love simplicity and ease. Hence, we can say that Digital payments are the future of fund transfer and money transactions.

Lower risk: Digital transactions are much more secure than traditional transactions because they are processed by secure gateways which are hard to tamper with.

Easily traceable: Details of payments are stored in a merchant-specific database. Both merchants and customers have easy access to payment information. This avoids ambiguity and confusion while tracking payments.

ABOUT ORBITZPAY

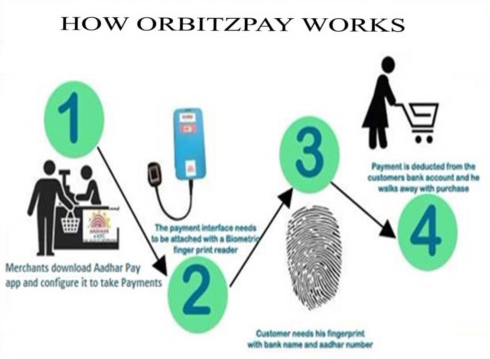

ORBITZPAY is meant for merchants to receive digital payments from customers over the counter through Aadhaar authentication. It allows for any merchant associated with any acquiring bank on ORBITZPAY service, to allow the merchant to accept payment from a customer of any bank, by authenticating the customer's biometrics - currently only fingerprints, directly from the customer's Aadhaar enabled bank account and receive the sale proceeds instantaneously directly intomerchant's own bank account.

To be able to effect the same, the merchant must have an Android mobile with the ORBITZPAYapp and a certified biometric scanner attached with the mobile phone on the USB port AND both the merchant and customer should have had linked their Aadhaar numbers to their bank accounts respectively.

ORBITZPAY Advantages

- Inter-operable

- Instant transfer, 24X7 availability

- No peripherals required for customers to make payments like cards and smart phone

- Secure and safe as it is based on biometric authentication.

Benefits to Merchants

- Seamless fund collection from customers

- Lower Transaction charges

- Safe and secure

- Instant account to account fund transfer

- Increased customer satisfaction as process saves time

- Easy reconciliation

- Eliminates cash handling cost and risk.

- Easy to carry

Transactions on ORBITZPAY:

Smartphone ORBITZPAY App with reliable data connection, Fingerprint Scanner (Biometric Device), Any E-KYC Done Bank Account.

Benefits to Customers

- No need for a smart phone to make payments

- No need to remember PIN & Passwords

- Customer ease, easiest way of cashless payment

- Pay from any Aadhaar enabled bank account

- No security issue as payments are done through biometric authentication

- No need to carry cash/cards.

Transactions on ORBITZPAY :

Aadhaar number & Any Bank account with Aadhaar linked.

Comparison ORBITZPAY Vs POS Terminal

| S.No | Specifications | ORBITZPAY | Typical POS |

|---|---|---|---|

| 1 | Settlement | Same Day | T + 2 Day |

| 2 | MDR | Low | High |

| 3 | Rent | Low Rent | High Rent |

| 4 | Confirmation of Transaction | Yes | No |

| 5 | Technical Error | No | No |

| 6 | SIM | No | Yes |

| 7 | Power | No | Yes |

| 8 | Paper Roll | No | Yes |

| 9 | Bank Cross Check | No | Yes |

| 10 | Services | One Application with All Services | Only One Service |

| 11 | Self-Authentication | Yes | No |

| 12 | Maintenance | One Time Setup | Regular |

HOW ORBITZPAY (Aadhar pay) Works:

AEPS (Cashless ATM)

Executive Summary

National Payments Corporation of India (NPCI) is formed as an umbrellainstitution for all the retailpayments systems in the country. The core objective isto consolidate and integrate the multiplesystems with varying service levels intonation-wide uniform and standard business process for allretail paymentsystems. The other objective was to facilitate an affordable payment mechanismto benefit the common man across the country and help financial inclusion.Vision and formation ofNPCI is backed by the regulator and Indian BanksAssociation (IBA). NPCI has defined business lines toprocess in country interbanktransactions for ATM, POS, 24*7 Remittance, ACH and CTS.

Government of India has initiated Unique Identification Project for citizensof India. It is envisaged touse the UIDAI schema and infrastructure for thefinancial inclusion in India. To enable the customersto use AADHAAR forthe financial transaction across the payment networks in the country,NPCIproposes to facilitate routing of transactions to the central idrepository of UIDAI for userauthentication through a single interface.This interface document is targeted to achieve inter-operability betweenbanks for Aadhaar based payment transactions.

NPCI shall allow banks to connect using this interface. It is also possible thatbanks may position theirrespective financial inclusion service provider toconnect on their behalf to NPCI centralinfrastructure with the complete onuswith the respective member bank.

Scope & Audience of this document

This document covers detailed description of the data elements in the ISO 8583standard paymentmessage specifications specific to Aadhaar Enabled PaymentSystem (AEPS), it also captures details ofmessage dumps for various transactionssupported in the AEPS product. Sample receipt formats arealso part of the scopeof this document to help the MicroATM application vendors.

ORBITZPAY- UTILITY/DIGITAL PAYMENT SEGMENTS

- RECHARGES & BILL PAYMENTS.

- BUS/HOTELS/FLIGHTS.

- MONEY TRANSFERS.(DOMESTIC MONEY REMITENCE/DOMESTIC MONEY TRANSFER)

- PAN CARD SERVICE.(FROM UTI WEBSITE)

- AADHAAR PAYMENT/COLLECTION MODE- Low MERCHANT DISCOUNT RATES

- AEPS (AADHAAR ENABLE PAYMENT SYSTEM)- CASHLESS ATM.

- P.O.S ( Point Of Sale )

- UPI(UNIFIED PAYMENT INTERFACE). B2B,M2M

- BUSINESS CARDS.(UP TO 2 CR, 3 MONTHS AVERAGE BALANCE BANK STATEMENT REQUIRED)

- BHARATH QR CODE.

- E-LENDING VENDOR FOR LOANS.

- AADHAAR SEEDING APP.

- PAYMENT GATEWAY.(CUSTOMER RELATION MANAGEMENT-CRM)

Industries & Services

IT/BPO/CBS/ERP/Digital Marketing

Stock Broking / Capital Market

Advertising / Media

Claim Management

Fashion Technology

Electrical / Electronics

E-commerce/Digital Payments

Pharma / Biotech / Healthcare

Education / Admin / HR Services

Hotels / Resorts

Restaurants / Food Processing

Agri Rural Bussiness

Consumer Durables

Automobiles

Jewellery / FMCG & Retail

Facility Management

Assests Recovery

Re-Construction Cell

Tours & Travels Management

Oil / Gas / Solar Power